Why we are evolved to lose money?

W.T…Finance — a single unbiased source for financial signals which matter to you.

Our ancestors had to fight many battles to survive.

Food, animals, hostile environments almost everything was against them.

For fighting these dangers, our brain developed what is often called “System-1” a system to assess risk quickly, identify the threat and then in most cases either freeze or flight.

As we evolved, we also developed what is called “System-2” which is a more logical, systematic thinking part of the brain.

How does the financial world play this?

Almost all marketing, products and tools are designed to stimulate your System-1.

Credit Cards would advertise you to spend more or you will miss the deal.

Trading platforms will give you indications to trade immediately else you lose the chance to make money.

Insurance platforms will show you the fear of losing. The best way to counter this is to allow your System-2 to take this decision which is far harder than said.

In this weeks letter, we speak about evolution and behaviour science.

Numbers that matter to us 📉📈

TL;DR- Best of Articles, Tweets, Videos and blogs 📖📖

Morgan Housel on Psychology of Money

That’s because investing is not the study of finance. It’s the study of how people behave with money. And behavior is hard to teach, even to really smart people. You can’t sum up behavior with formulas to memorize or spreadsheet models to follow. Behavior is inborn, varies by person, is hard to measure, changes over time, and people are prone to deny its existence, especially when describing themselves.

Daniel Kahneman on traps which makes us take poor decisions

Ben Carlson on why regression to mean is so hard

3 reasons regression to the mean can be such a frustrating guide to the investment decision-making process:

(1) Sometimes it happens at such a slow pace that any shock to the system can disrupt the process.

(2) Sometimes the regression happens so swiftly it overshoots to the upside or downside.

(3) Sometimes the mean itself is unstable, meaning yesterday’s normal can be replaced by a new normal if something has changed within the system.

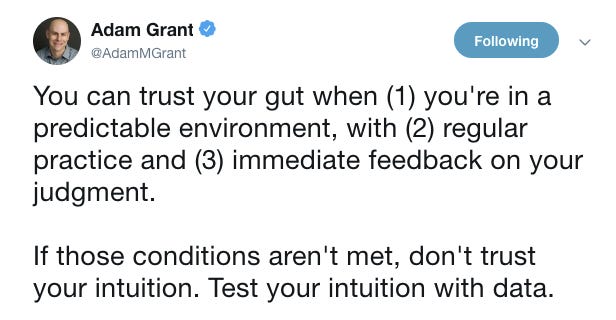

Adam Grant on using Gut and you can see why using Gut in finance without the hours is usually a losing proposition

Business Story on Evolution

One of the companies which have played the evolution game to perfection is Intel. How they evolved themselves by destroying their largest division is the stuff of legends. The below article from HBR is a great one to read about this.

Life in the memory business was tough. As Grove describes it, the Japanese semiconductor manufacturers decided to win this business with the 10% rule: They would undercut Intel by 10% to get the customer. If Intel matched, they would undercut by another 10%—and so on until they got the customer.

This policy created a crisis, or SIP, for Intel. A decision had to be made, and various options were proposed. One suggestion was to build a giant new dedicated factory in the hopes of establishing a cost advantage over Intel’s Japanese competitors. Another was to push the technology envelope and develop a new and superior memory chip. Another was to target niche markets.

After almost a year of frustrating debates and much dithering, Grove came to realize that none of those options were the answer to Intel’s problems. In fact, there was no solution to be found within the memory business. Even then, Grove didn’t find it easy to imagine abandoning the business in which Intel had gotten its start: “Intel equaled memories in all of our minds.” To come to grips with the crisis, he had to take himself and his own baggage out of the picture.

Here’s how he did it. In the midst of the doldrums of 1985, Grove posed a hypothetical question to his colleague Gordon Moore: “If we got kicked out and the board brought in a new CEO, what do you think he would do?” Moore answered without hesitation, “He would get us out of memories.” To which Grove responded, “Why shouldn’t you and I walk out the door, come back and do it ourselves?”

That’s just what they did. They redirected Intel’s resources away from memories and into its microprocessor business—which, at the time, played second fiddle to Intel’s memory business. True, Intel had invented the microprocessor back in 1971, but in the mid-1980s, second sourcing had created multiple competitors, and a downturn had led to excess capacity. Microprocessors weren’t an obviously attractive business. The bold decision to commit Intel’s future to microprocessors nevertheless saved the company and started it on the road to today’s greatness.

Chart of the week

With oil at all-time lows is the start of evolution towards new energy sources. Below is a list of oil producers by size

Hey, I am Saurabh, with my Lockdown locks :)

Each week I curate interesting personal finance stuff

Short, Simple and stuff which you can use

4.5k users read it and would love to have you join us

![r/dataisbeautiful - Top 10 Countries by Yearly Oil Production [OC] r/dataisbeautiful - Top 10 Countries by Yearly Oil Production [OC]](https://substackcdn.com/image/fetch/$s_!6ZPW!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fbucketeer-e05bbc84-baa3-437e-9518-adb32be77984.s3.amazonaws.com%2Fpublic%2Fimages%2F0ba897c6-67be-4f01-ba76-e0913e4b1242_763x285.png)