Once upon a time Khidr, the Teacher of Moses, called upon mankind with a warning. He said all the water in the world which had not been specially hoarded would disappear at a specific date. It would then be renewed, with different water, which would drive men mad.

Only one man listened to the meaning of this advice. He collected water, went to a secure place where he stored it and waited for the water to change its character.

On the appointed date, the streams stopped running, the wells went dry, and the man who had listened, seeing this happening, went to his retreat and drank his preserved water. When he saw, from his security, the waterfalls again beginning to flow, this man descended among the other sons of men.

He found that they were thinking and talking in an entirely different way from before; yet they had no memory of what had happened, nor of having been warned. When he tried to speak to them, he realised that they thought he was mad, and they showed hostility or compassion, not understanding.

At first, he drank none of the new water, but went back to his concealment, to draw on his supplies, every day. Finally, however, he decided to drink the new water because he could not bear the loneliness of living, behaving and thinking differently from everyone else. He drank the new water and became like the rest.

Then he forgot all about his store of special water, and his fellows began to look upon him as a madman who had miraculously been restored to sanity.

This is an old Sufi Story ( Tales of Dervishes), but it tells how narratives work and how anyone outside it will find it hard not be part of the narrative. While may like it or not its hard to skip these narratives. And unfortunately, these are highly prevalent when it comes to money.

But how do these narratives happen and why do they take root in our heads. To understand this, we have to look at various subjects.

Cognitive psychology and neuroscience: We use this to look at how memories are created cause they are a vital part of our narratives. Memories are never an exact representation of money in the past; rather they represent the past with colours of what we want to feel and enjoy. The fate of memory is mostly determined by how much it means to us. Personal memories are essential to us. They are tied to our hopes, our values, and our identities. Memories that contribute meaningfully to our autobiography prevail in our minds.

Behaviour Science: Our memories get coloured due to what we see and hear. Anyone trying to make you part of a narrative will consciously or unconsciously try tools like making the interaction vivid, always present in your interactions, or showing authority figures or showing social proof. If you like someone ( a friend) or if an authority figure says something vividly, there is a high tendency to agree with them. On the other hand, anyone who is not above two when they say something negative will appear to you as outlandish.

Feedback Loops: While a narrative is being told the oldest trick used is to make a tiny part of it true. Once this happens, we assume we our belief in narrative increases many folds.

Evolution: We are wired in a way that if the brain anticipates that it will be rewarded for adopting a particular belief, it's delighted to do so. It doesn't care for the form of reward. That reward could be better actual results, more bragging rights, more followers et Cetra. It doesn't matter

Any narrative is usually a combination of the above elements. We don't have a solution of how not to be part of a narrative but knowing the root cause might help us detect them.

Coming to some of the widespread financial narratives over a few years

Equities always work: A narrative made popular by followers of value investors. However, it doesn't tell adequately that equity for most people has to be a portion of their asset allocation and needs to be adjusted as life progresses.

Term Plan+ MF always works: Made popular by FinTwit. It assumes that you will remain rationale for 25 years and have the discipline not to sell your mutual funds when they are 400% up.

Real estate/Gold is a bad asset class: Made famous by many financial advisors. It lacks the understanding that money's final objective is happiness and not just increasing wealth.

Compounding will make you Rich: Made famous by every single fund house. It skips the part that you may be able to enjoy your wealth by the time you become rich, and you are creating wealth, not for you but your future generations.

None of the narratives is wrong or bad, but you need to figure out if that is a narrative right for you.

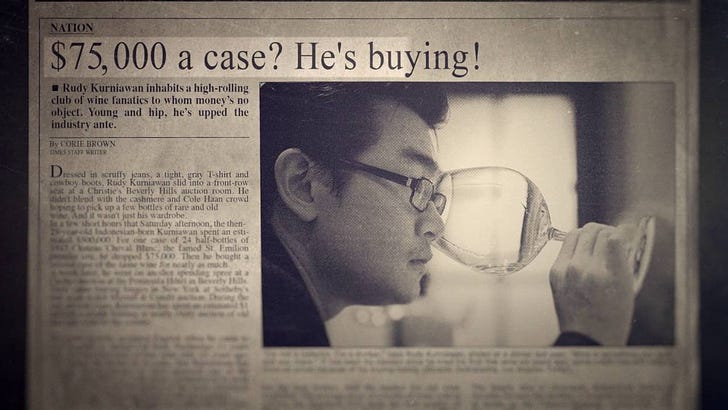

And before we enjoy this movie on how an Asian created a narrative of being the worlds leading wine savant and duped the wealthiest.

Thanks Saurabh! Neatly written and to the point and really like the conclusion that it's the person who experiencing the narrative had to decide whether to leave it or enjoy with it.