Insurance: Your first step to being anti-fragile

W.T…Finance — a single unbiased source for financial signals which matter to you.

A lot of us would have read about Anti-Fragile the book and concept by Naseem Taleb. Essentially it argues that anti-fragile is anything which gets better with chaos, disorder and time.

Tranquil environments result in fragile systems, often giving false hope that we are prepared for everything.

Now if we look at our lives, especially in Corona times you will realise that it is anything but tranquil. Yet most personal finance decisions are taken assuming calm environment.

One tool which enables you to gain from disorder and chaos in your lives is Insurance. You get sick, or house catches fire, or you die, all these events can put the family in turmoil. All of them are far from regular events, but they test the fragility of your household. Insurance in such situations makes you anti-fragile.

And therefore, it's it the essential tool to have before any other. The problem though is these events often in tranquil environments are belittled, and hence the need for adequate Insurance is never there.

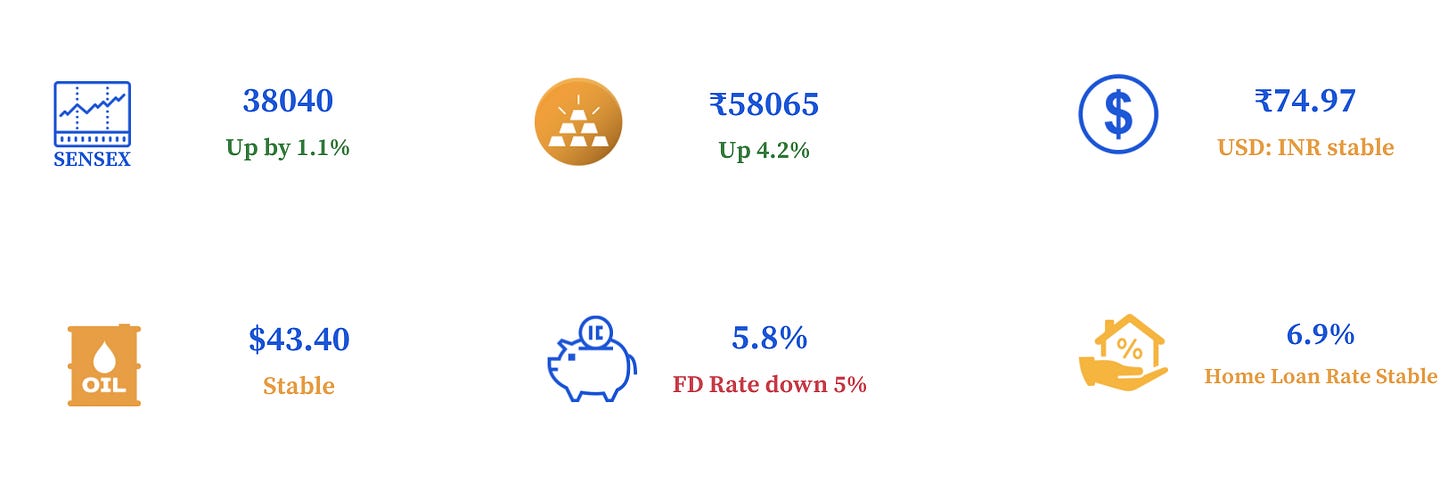

Numbers that matter to us 📉📈

TL;DR- Best of Articles, Tweets, Videos and blogs 📖📖

You don't need an alpha returns in investing & why protection is more important

This same argument can be easily translated to investing where professional investors seek out market-beating performance (“alpha”) that is completely unnecessary for retail investors like us. The difference here is that professionals have billions of dollars they are trying to manage, while you and I only have money in the thousands to millions range.

Retail Traders Beware: You are competing against these masters

Yes. I happen to know a few hawala dealers who create fake invoices for companies, which helps them show artificial expenses and (artificial) revenues. I ask them about companies which do it too often. That tells me something about the company’s numbers which the profit & loss statement won’t.

Learnings for long term investors from Traders

For a trader, the mindset of capital preservation first, makes him far far more detached than a typical value investor who tends to fall in love with his ideas and cling to those ideas even when evidence warrants a change of mind.

Rory Sutherland and personal finance

Just a few wrong assumptions in statistics, when compounded, can lead to an intelligent man being wrong by a factor of about 100,000,000 - tarot cards are rarely this dangerous.

Business Story

Helps you understand that underlying business of Insurance is risk prediction

Berkshire Hathaway Insures $1 Billion Prize for Predicting NCAA Winners

Warren Buffett’s Berkshire Hathaway Inc. is backing a $1 billion prize offered by Quicken Loans Inc. if a contestant predicts the winner of each game in the National Collegiate Athletic Association’s men’s basketball tournament.

The prize will be paid in 40 annual installments of $25 million and split among multiple winners if there is more than one perfect entrant, the Detroit-based lender said today in a statement. The winner also has the option of a single payment of $500 million.

Berkshire has specialized in unusual insurance risks for decades, protecting clients against big losses in return for premium payments. The Omaha, Nebraska-based company won a bet in 2010 on the World Cup after France was eliminated from the tournament in South Africa. Berkshire has previously guaranteed against the potential payout of $1 billion in a contest sponsored by PepsiCo Inc.

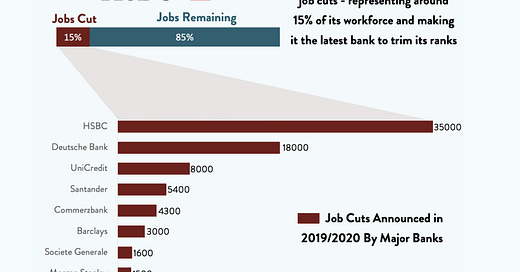

Chart of Week

Join more than 3800 readers who are getting a “ Refreshing” view on Finance.

If you love this letter please do spread your love by sharing it.